If you've read my posts about gold over the last month you know that while "paper gold" has been selling off (In the form of GLD) the physical gold market has been extremely strong. I have speculated that the GLD etf has been an important source of physical gold and that its decline was engineered to allow bullion dealers to get at some of the etf's physical supply (When GLD is sold off, the custodian doesn't need to hold as much physical gold to back its shares.) You'd also know that hot money is betting big on gold going down. Hedgies are short the GLD etf even as demand soars around the world.

Several recent posts provide important background as to what's going on behind the scenes.

First, Gold supply is tightening. From Goldcore:

Secondly, GLD is sold to make physical gold available. Billionaire Eric Sprott via KWN:

Gold Bar “Supply Constraints” In Singapore Sees Record Premiums

Gold rose to a one-week high, as the dollar and stocks retreated after another 5% plunge in Japan’s Nikkei. Silver, platinum and palladium advanced also.

Physical gold demand remains robust internationally and supply issues in Singapore have led to premiums reaching a record high there.

Gold Spot $/oz, Daily, 3 Year – (Bloomberg)

Some of the buying on futures markets may be shorts being forced to cover their record short position. The COT (Commitments of Traders) data clearly shows that there is the strong possibility of a significant squeeze of speculators short gold. This could be a catalyst to propel gold higher.

Cross Currency Table – (Bloomberg)

Traders and speculators are watching the $1,413/oz resistance level. A daily close above this level will likely trigger the beginnings of a short squeeze.

Holdings in the largest bullion-backed exchange-traded product expanded yesterday for the first time since May 9.

Strong premiums for gold bars in Asia show that jewellers and investors are busy buying bullion on this dip. In Singapore, Reuters reports that “supply constraints” have sent premiums to “all time highs” at $7 to spot London prices.

Animal spirits are returning to the gold market in the ‘Land of the Dragon’ in this the ‘Year of the Snake’.

The volume for the Shanghai Gold Exchange’s benchmark cash contract surged to 19,599 kilograms yesterday from 15,641 kilograms the day before. In two days the volumes have nearly doubled and surged from 10,094 kilograms to 19,599 or 94%.

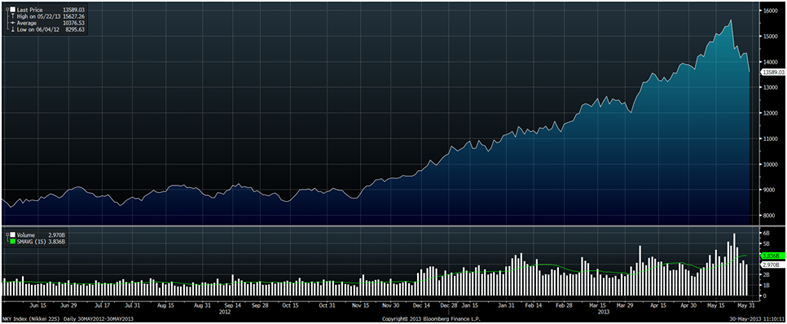

Nikkei Index, Daily, 1 Year – (Bloomberg)

Animal spirits have been greatly in evidence in global equity markets for many months now with abnormally strong gains seen in many surging markets. This is despite a very uncertain global economic outlook and great uncertainty regarding corporate earnings in the coming months.

With many stock markets overvalued on a host of benchmarks, there is the real risk of a material correction in the U.S. and other markets and this should lead to renewed diversification into gold.

It will also lead to renewed safe haven demand if other markets see stocks plummet as has been seen in Japan in recent days.

S&P 500 Index, Daily, 4 Year – (Bloomberg)

The 17% correction seen in the Nikkei in the last week alone, looks likely in the coming months in other markets which are increasingly being driven by liquidity, debt and margined speculation rather than value investing.

The rotatation out of gold and into stocks seen in recent months could reverse very quickly and investors may just as quickly rotate back into gold in order to hedge significant macroeconomic risks.

“It has been my view, and as many of your commentators and interviewees have mentioned, previous to the April 12th to 15th smash, it seemed that there was a clog-up in the delivery of gold throughout the system.

As (Egon) von Greyerz mentioned, whether it’s guys trying to get gold out of their Swiss banks, LBMA deliveries being extended, or people who can’t convert their COMEX contracts into physical gold, there were all sorts of things that suggested there was a tightness in gold. Including, of course, the COMEX inventories, the deliverable dealer inventories falling from 11 million ounces to 8 million ounces...

“It’s my hypothesis that there was a dearth (scarcity) of gold, and as you know I’ve written many articles questioning whether central banks had any gold left. The conclusion I had was of course that they didn’t because we could see all of this huge new demand coming in.I’m talking over a 10-year period where I can identify approximately 2,300 tons of net-new demand coming into a market where the supply was staying the same at roughly 4,000 tons a year. I said, ‘Well, this is physical delivery. Where is the gold coming from?’So it wasn’t a surprise for me to see that all of the sudden these anecdotal items were coming up about how people couldn’t get delivery (of gold). Then we start this decline by various major investment banks saying, ‘Short gold.’ What I think was really happening was that the shortage was becoming very, very acute.So I decided to do a comparison of Shanghai premiums to what happens to the GLD. Pretty well any time that the Shanghai premiums go up, the GLD inventory starts declining. GLD has lost about 300 tons of gold, which is a lot of tons of gold when you figure that the miners, ex-China, ex-Russia, only produce 2,200 tons of gold. This was 300 tons in the first four months of the year.King World News note: Eric Sprott sent the chart below exclusively to KWN and only for King World News to publish. Note the tremendous drain of gold out of the ETF GLD as the Shanghai premium expands.Even before the April 12th and 15th crash, the tonnages were already rolling out of the GLD. It’s my belief that that gold was being drained out of the GLD in order to supply the demand in Asia.Therefore, the whole of gold that went out of GLD, rather than being a sign of weakness which is what everyone was pointing to, it was not a sign of weakness. It was a sign that banks had no gold. Just imagine a situation where there is no gold to deliver. What’s the only other place you can go to? You can go to the GLD and start draining it.That’s why we’ve seen this huge decline in GLD because it’s actually the last bastion of supply to satisfy this demand. So I don’t regard the GLD losing gold as a sign of weakness whatsoever. It’s not institutional investors getting out of GLD. It’s the (gold from) GLD being shipped over to the East and someone spinning it as a weakness, and I totally disagree with their conclusion. In fact I think it’s quite a sign of strength. I would like all of the gold out of the GLD to disappear and let’s see what happens after that.”

Sound familiar? When Eric Sprott is thinking the along te same line that I am I'm very encouraged I'm on the right track. After all, he didn't become a billionaire by being dumb. Whereas I'm just some crazy blogger who watches global markets and tries to make sense of it all.

And lastly, the LBMA supplies continue to tighten. From Egon Von Greyerz via KWN:

“Just look at what’s happening in the physical gold market. The LBMA reported record gold transactions in April, of plus 25%. This is the highest level since gold peaked in September of 2011. So physical trading is at the same level where it was when gold was at its peak at $1,900. That’s extraordinary. The level of physical gold trading is incredible. We are seeing the same activity now as when gold was at its peak. And it proves that all of the selling is in the paper market.To me, its beginning to look like those massive record shorts I wrote about May 22nd, are about to be squeezed. When this happens those same hedgies will be forced to buy back gold to close out their positions and may cause the gold spot price to surge massively.

Remember, Eric, these were April figures. We have seen, and also refiners have seen much higher activity in May. So demand is even greater right now. I believe that we have seen the gold market finally turn to the upside, despite today’s pullback. It’s possible to see some consolidation before gold takes off, but the real move, when it starts and it won’t be far away, that will be massive.”

No comments:

Post a Comment