One day after the Fed announce it would slow QE from well over $1 Trillion per year to a slightly less obscene $900 Billion per year gold was hammered down $45. Its now retesting its July lows.

Its been another crushing year for those who believe in fundamentals. Last quarter showed slowing earnings with most companies failing to meet earnings expectations. Never mind. The stock market keeps going up. Meanwhile, the Fed printed $1 Trillion in new money, devaluing our US dollar. Yet gold continues going down. It makes absolutely no sense from any sort of macro economic perspective. But it makes perfect sense if you are the Federal Reserve. From their perspective, they want to see the stock market higher to create an artificial wealth effect that will spur consumers to go out and spend more, stimulating the economy. What they don't want, is for people to bail on their currency and move into an unproductive alternative currency like gold or silver. For that reason, I think we have seen the Fed is intentionally blowing a stock bubble while suppressing the price of precious metals. That artificially low price is a gift to people who know this will all end very badly.

MWP seeks to explore the global macro environment for investing in order to seek the best place to preserve and create wealth at a time of global deleveraging.

Thursday, December 19, 2013

Wednesday, December 18, 2013

The Printing Continues (But just a little less)

The Fed today announced it will reduce its QE of $85 Billion per month to a mere $75 Billion per month beginning next month. The stock market jumped 292 points on the news the printing party would go on. Of course, this news was celebrated as "evidence" the recovery was well under way. But the Fed said no such thing and positioned themselves to either increase or decrease the printing depending on future economic data points,

Michael Pento, pictured above said it well in a KWN interview:

Michael Pento, pictured above said it well in a KWN interview:

Eric King: “Michael, as the economy rolls over in Europe and in the United States, how will they (the Fed) keep the taper on without a full blown collapse?”Pento: “They won’t be able to. In fact, a reporter asked Mr. Bernanke what would happen if the economy were to falter in 2014, precisely due to the taper, and he said, ‘The taper could be reversed and asset purchases could be increased.’....

Saturday, December 7, 2013

200k New Jobs is Good News? You've Got to be Kidding Me?

Recently you may have heard about fast food workers striking, asking for higher wages and President Obama endorsing an increase to the minimum wage to $10.10 per hour. And why not? After all we were told the "good news" that 200k jobs were created last month! Never mind that most of those jobs were part time. The main stream media celebrated the "great" numbers a s a sign the economy is picking up, even speculating that the Fed may begin tapering their $85 Billion per month printing spree.

But haven't we been told this by the same media outlets for the last five years? Do the media have any credibility after years of cheer leading the economy? Does our government have any credibility now that we know the Census Bureau cooked the books just before the 2012 election?

Let's set aside the BS happy talk and look at some unpleasant reality shall we?

But haven't we been told this by the same media outlets for the last five years? Do the media have any credibility after years of cheer leading the economy? Does our government have any credibility now that we know the Census Bureau cooked the books just before the 2012 election?

Let's set aside the BS happy talk and look at some unpleasant reality shall we?

Wednesday, December 4, 2013

Selling Bitcoins and Buying Gold

This is interesting.

Both gold and Bitcoins are in demand by people seeking a sound currency that cannot be debased by governments. But it would seem that despite the growing popularity of Bitcoin, ultimately people prefer to own the currency with the 5,000 year history vs the new up and comer.

From Business Insider:

Both gold and Bitcoins are in demand by people seeking a sound currency that cannot be debased by governments. But it would seem that despite the growing popularity of Bitcoin, ultimately people prefer to own the currency with the 5,000 year history vs the new up and comer.

From Business Insider:

Gold and silver bullion was apparently among the biggest selling items on Bitcoin Black Friday.

According to Bitpay, one of the largest Bitcoin payment processors, the top-three online retailers on November 29 were KnCMiner (whose gonzo order volume for its latest mining device we told you about yesterday), Gyft, and Amagi Metals.

Amagi Metals chief Stephen McAskill told BI in a separate interview that his site processed $900,000 worth of bitcoin between Thanksgiving and Sunday. The biggest selling items were silver and gold coins and bars, he said.

"To me it makes sense," he said. "A lot of bitcoin enthusiasts are interested in sound money, money that doesn't lose value."But there are still enough users who think bitcoin will someday retain the value of gold, he said.We asked Gyft, a gift card site, for any more data about what people bought with Bitcoin, and spokesman Ian Chaffee could only say electronics and food.

For the month of November, Bitpay processed 55,288 bitcoin transactions. They did not provide us with a total dollar figure for the month. Here's a chart:

This is why I believe the ultimate currency is gold in the form of Goldbulliondebitcard .

Once physical gold can be spent in tiny increments of milligrams and paid with the convenience of the global debit card network, we will have an independent currency able to make transactions anywhere in the world. A truly international currency.

Tuesday, December 3, 2013

Crazy Markets And Where We Are Now ( And Graphs That WIll Shock You)

With the year coming to an end and gold retesting its July low around $1,150 per ounce I just thought I'd review where we are in markets relative to each other and what we should expect going forward into 2014.

Currently the US stock market as represented by the S&P 500 is up nearly 28% while gold is (ironically or purposely?) the mirror opposite at a loss of nearly 28%. Meanwhile the US Fed as left unchanged their unprecedented purchases/ printing of $85 Billion per month of monetary expansion.

Friday, November 8, 2013

Keeping Your Sanity

Bill Fleckenstein wrote a column that I read regularly in the mid 2000's in which he often described how the easy credit in the mortgage industry was going to lead to a disaster. At the time, I thought he sounded like a perma bear. In 2008 he was proven absolutely right. Though less famous than others, who made hundreds of millions, he was right never the less. So when he writes about the next coming disaster I listen.

Thursday, October 24, 2013

Classic Sign of a Market Top

From CNBC on a rare occasion it actually performs financial journalism:

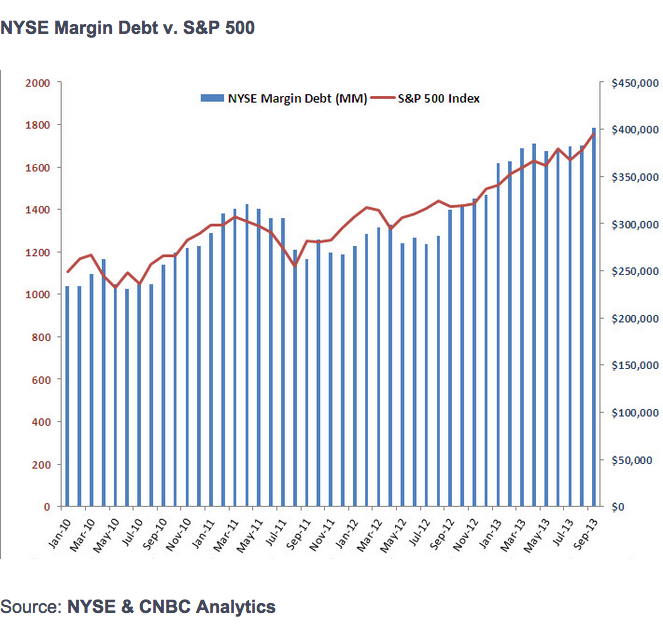

With stocks near all-time highs, investors are taking on record levels of margin debt, something that could accelerate a decline if the market turns south.

Margin levels, or the amount borrowed to purchase securities, climbed to a new record of $401 billion in September, according to NYSE Euronext data released this week. The monthly increase of 4.78 percent was also the largest gain since January. The NYSE figures represent the margin accounts of member firms.

"Investors love going on margin in a rising market environment, but when the market declines, it can be extremely painful" says Paul Hickey, co-founder of Bespoke Investment Group. "Don't forget that if you go on margin you also have to pay interest on that loan, and some brokers charge pretty high rates, so you are already starting in the hole." So far this year, the S&P 500 is up 23 percent, while other major indexes such as the NASDAQ and Dow Transports have spiked 30 percent and 32 percent, respectively.

So far this year, the S&P 500 is up 23 percent, while other major indexes such as the NASDAQ and Dow Transports have spiked 30 percent and 32 percent, respectively.

Prior to the financial crisis, debt margins peaked at $381 billion in July, 2007, three months before the S&P 500 hit an all-time high.

Currently, the Federal Reserve's Regulation T allows investors to borrow up to 50 percent of the price of a securities purchased on margin. The Fed has not changed the margin requirements since 1974.

Even if high levels of margin sound alarming, they do not necessarily signal a red flag. Dan Greenhaus, Chief Global Strategist at BTIG, highlights that peaks in margin debt coincided with peaks in stock markets. "However, there's nothing to say that today, tomorrow or the next day is ultimately the peak. Like stock prices, we only know in hindsight," he said.

Just to put this into a greater context, compare other periods of margin highs with subsequent market drops. In this graph, the margin balance is calculated slightly differently but is illustrative never the less. The blue line is the market and the red area is shown as the negative (margined) credit balance up to September:

"Earning Zero is the Best Investment"

When is earning zero the best investment? When you're expecting the US stock market to reverse by 40%. Mark Spitznagel doesn't believe there needs to be a "catalyst" like the end of QE or even a tapering (which will likely never come).

As Bartiromo mentions, Spitznagel had 100% return in 2008 while markets were down by a third. He also recognizes that people in cash feel "foolish" as the market heads higher. But he also recognizes the gains are illusory. Few will have the timing to get out before the market sours and sentiment changes.

Being positioned in cash will allow you the extraordinary opportunity to go on a discount shopping spree when there are ten sellers for every buyer. These are the times that long lasting wealth is created. Retail investors should watch SDY, an ETF made up of large blue chip US companies with proven track records of steadily increasing dividend payments. As of today, its yield is 2.45%. When it starts to approach 5% in a sell off (The yield rises as the price goes down) it will be a good time to buy

Its is exactly these times of crisis that Warren Buffet has stepped in with his cash rich insurance fund to buy at deep discounts. This will also be the time that retired Americans who have suffered under the Fed's financial repression will finally be able to buy investments, including stocks, with high yields to fund their retirements. Few will be ready.

Tuesday, October 22, 2013

Incredible Interview with Jim Rickards

Readers of this site will recognize many of the themes Rickards discusses. Still, its amazing to hear it from him. Those themes are:

- Long term interest rates will not be allowed to rise.

- We are in a depression, not a recession.

- Depressions require structural reforms not more liquidity.

- Fed policy (QE) is following Japan's previous decades with the same results.

- The Dollar as a world reserve currency will not last.

- A rise in gold will happen eventually with either inflation or deflation.

Monday, October 21, 2013

China Knows America is Broken

As an American is saddens me to watch this. We are going down a dark path,

Alasdair Macleod via GoldMoney.com,

China is now overtly pushing for the US dollar to be replaced as the world’s reserve currency.

Alasdair Macleod via GoldMoney.com,

China is now overtly pushing for the US dollar to be replaced as the world’s reserve currency.

Xinhua, China’s official press agency on Sunday ran an op-ed article which kicked off as follows:

“As U.S. politicians of both political parties are still shuffling back and forth between the White House and the Capitol Hill without striking a viable deal to bring normality to the body politic they brag about, it is perhaps a good time for the befuddled world to start considering building a de-Americanized world.”China does have a broad strategy to prepare for this event. She is encouraging the creation of an international market in her own currency through the twin centres of Hong Kong and London, side-lining New York, and she is actively promoting through the Shanghai Cooperation Organisation (SCO) non-dollar trade settlement across the whole of Asia. She has also been covertly building her gold reserves while overtly encouraging her citizens to accumulate gold as well.

There can be little doubt from these actions that China is preparing herself for the demise of the dollar, at least as the world’s reserve currency. Central to insuring herself and her citizens against this outcome is gold. China has invested heavily in domestic mine production and is now the largest producer at an estimated 440 tonnes annually, and she is also looking to buy up gold mines elsewhere. Little or none of the domestically mined gold is seen in the market, so it is a reasonable assumption the Government is quietly accumulating all her own production without it becoming publicly available.

Recorded demand for gold from China’s private sector has escalated to the point where their demand now accounts for significantly more than the rest of the world’s mine production. The Shanghai Gold Exchange is the mainland monopoly for physical delivery, and Hong Kong acts as a separate interacting hub. Between them in the first eight months of 2013 they have delivered 1,730 tonnes into private hands, or an annualised rate of 2,600 tonnes.

The world ex-China mines an estimated 2,260 tonnes, leaving a supply deficit for not only the rest of gold-hungry South-east Asia and India, but the rest of the world as well. It is this fact that gives meat to the suspicion that Western central bank monetary gold is being supplied keep the price down, because ETF sales and diminishing supplies of non-Asian scrap have been wholly insufficient to satisfy this surge in demand.

So why is the Chinese Government so keen on gold? The answer most likely involves geo-politics. And here it is worth noting that through the SCO, China and Russia with the support of most of the countries in between them are building an economic bloc with a common feature: gold. It is noticeable that while the West’s financial system has been bad-mouthing gold, all the members of the SCO, including most of its prospective members, have been accumulating it. The result is a strong vein of gold throughout Asia while the West has left itself dangerously exposed.

The West selling its stocks of gold has become the biggest strategic gamble in financial history. We are committing ourselves entirely to fiat currencies, which our central banks are now having to issue in accelerating quantities. In the process China and Russia have been handed ultimate economic power on a plate.

Saturday, October 19, 2013

The US Dollar and a Rising China

From the Economic Collapse Blog:

On the global financial stage, China is playing chess while the U.S. is playing checkers, and the Chinese are now accelerating their long-term plan to dethrone the U.S. dollar. You see, the truth is that China does not plan to allow the U.S. financial system to dominate the world indefinitely. Right now, China is the number one exporter on the globe and China will have the largest economy on the planet at some point in the coming years.

The Chinese would like to see global currency usage reflect this shift in global economic power. At the moment, most global trade is conducted in U.S. dollars and more than 60 percent of all global foreign exchange reserves are held in U.S. dollars. This gives the United States an enormous built-in advantage, but thanks to decades of incredibly bad decisions this advantage is starting to erode. And due to the recent political instability in Washington D.C., the Chinese sense vulnerability. China has begun to publicly mock the level of U.S. debt, Chinese officials have publicly threatened to stop buying any more U.S. debt, the Chinese have started to aggressively make currency swap agreements with other major global powers, and China has been accumulating unprecedented amounts of gold. All of these moves are setting up the moment in the future when China will completely pull the rug out from under the U.S. dollar.

Saturday, October 12, 2013

Don't Freak Out: Gold, the Debt Crisis and Janet Yellen

I just wanted to write some quick notes about the last week and the issues involved with gold reaching its lowest point since July of 2010, Janet Yellen replacing Ben Bernanke and the US government shutdown and the impending debt ceiling and what it means and does not mean.

I will likely come back and update this post to expand in the coming days so you may want to revisit it Sunday or Monday.

The government shutdown and debt ceiling.

This subject is never really explained well by media or is explained poorly. In addition, some politicians are out right misrepresenting what will happen for political purposes to scare citizens into action.

The previous spending bill agreed to by Congress and the President has now expired. When they cannot agree on a new spending bill we get a "government shut down". What that means is that discretionary spending cannot continue but essential services are continued. Since two thirds of government spending are made up of entitlements like Medicare, Medicaid and Social Security, that part is unaffected. The rest, either continues or not depending on whether they are essential services or not. One example is most military spending. So as of today's writing about 80% of the normal level of government is still operating unchanged.

The debt ceiling is something different.

Sunday, October 6, 2013

Getting to ONE: the Dow / Gold Ratio

I've written about the Dow / Gold ratio several times noting that there seems to be a long term cycle where the ratio hits one or nearly one. We were quickly moving back toward a ratio of one when the Fed embarked on Quantitative Easing to reflate the Dow and then in 2011 began to intervene in the gold markets to keep the dollar relatively strong and the gold price week. Though the economy wallows in low growth recession/depression the Fed has been successful in reflating the Dow and knocking down the price of gold. But Fed intervention loses its efficacy the longer it drags on requiring ever larger amounts of dollar printing to keep the prices from reverting to their natural equilibrium.

Its my belief, this is unavoidable and eventually either the forces of inflation will over power gold's manipulation or the Dow must decline towards its intrinsic value once the collective minds of the market admit there is no recovery. Today I examine commentary from Jim Rickards and Richard Russell who are both legends in their own right. One examines gold and how it gets to $5,000 and one who examines the Dow and how it reverts to 5,000. In essence, together, how the Dow/ Gold ratio gets to one

Its my belief, this is unavoidable and eventually either the forces of inflation will over power gold's manipulation or the Dow must decline towards its intrinsic value once the collective minds of the market admit there is no recovery. Today I examine commentary from Jim Rickards and Richard Russell who are both legends in their own right. One examines gold and how it gets to $5,000 and one who examines the Dow and how it reverts to 5,000. In essence, together, how the Dow/ Gold ratio gets to one

Friday, October 4, 2013

A Reminder of the US Debt Limit and its Correlation with Gold

Monday, September 23, 2013

WA Times: Volcker sees US Economic Disaster by March 2014

From the Washington Times dated October 25, 2012. All bolded emphasis is mine.

The central problem is that America is the bank of the world. What this means, simply, is that the dollar is the world’s currency (often termed the “reserve currency”). Throughout the world, nearly all traded goods, oil, major commodities, real estate, etc., are denominated in dollars. The world needs dollars, and the U.S. provides them and provides confidence that the dollar is the “safest” currency in the world. Countries get dollars by trading with us on attractive terms, which enables Americans to live very well. Countries support this system and cover their risk by investing in dollars through T-bill auctions and other mechanisms, which enables us to run budget deficits — up to a point.

The central issue is confidence in America, and the world is losing confidence quickly. At a certain point, soon, the United States will reach a level of deficit spending and debt at which the countries of the world will lose faith in America and begin to withdraw their investments. Many leading economists and bankers think another trillion dollars or so may do it. A run on the bank will start suddenly, build quickly and snowball.

Friday, September 20, 2013

The Dollar After the Fed's Decision Not To Taper

Egon von Greyerz via KWN (Bold emphasis is mine):

Eric King: “Egon, astonishingly, you correctly predicted that there would be no Fed tapering this week. That Fed decision certainly shocked the world and shocked the financial markets. Where do we go from here?”Greyerz: “Yes, Eric. It did not surprise me at all that the Fed did not taper because for a patient on life support that is not the time to turn off the machine because that machine is what keeps the patient alive artificially. So how can the Fed possibly slow tapering?

The US is a country with a total government debt of $220 trillion, unemployment at 23%, the job participation rate at the lowest level since the 1970s, median household incomes at multi-decade lows, and real-GDP declining since 2006. We have also seen federal debt double since 2006, and consumer credit has been exploding. So the picture is clear....

Thursday, September 12, 2013

Shanghai Slam Breaks Gold Market

I haven't posted for a while because I've been working on progress towards making the first Gold Bullion Debit Card a reality. If you're interested in learning more you can check out the beta website being developed at http://goldbulliondebitcard.cloudaccess.net/

Now to Shanghai. From ZeroHedge:

There was a time when, if selling a sizable amount of a security, one tried to get the best execution price and not alert the buyers comprising the bid stack that there is

(substantial) volume for sale. Of course, there was and always has been a time when one tried to manipulate prices by slamming the bid until it was fully taken out, usually just before close of trading, an illegal practice known as "banging the close." It appears that when it comes to gold, the former is long gone history, and the latter is perfectly legal. As the two charts below from Nanex demonstrate, overnight just before 3 am Eastern, a block of just 2000 GC gold futures contracts slammed the price of gold, on no news as usual, sending it lower by $10/oz. However, that is not new: such slamdowns happen every day in the gold market, and the CFTC constantly turns a blind eye. What was different about last night's slam however, is that this time whoever was doing the forced, manipulation selling, just happened to also break the market. Indeed: following the hit, the entire gold market was NASDARKed for 20 seconds after a circuit breaker halted trading!

Tuesday, August 20, 2013

Western central banks are running out of gold to deliver into the system

William Kaye is back on KWN. Emphasis is mine. This is a must read interview:

Kaye: “Investors need to be focused on the numbers that are involved in the gold market. The available feedstock of gold and other precious metals that is necessary to prevent the paper market from being bifurcated from the physical market is being rapidly depleted.This gets no attention in any of the mainstream media. It’s absolutely amazing. You are not going to read about this in the Financial Times or the Wall Street Journal or any bank sell-side reports for that matter..

“But the people who do serious work, whether it’s Grant Williams or Andrew Maguire, people like us and a handful of others, the numbers speak for themselves. Mine production is plummeting rapidly. If metals prices were, for some bizarre reason, to stay where they are today, roughly 25% of mine production would be taken out of the market. That’s a staggering number.2,600 tons of gold were produced and sold into the market in 2012. At current run-rates, we believe that only 2,200 tons of gold will be sold into the market. The production numbers have gone down rapidly because of depressed prices. Those numbers will continue to fall if gold prices don’t rise dramatically from where they are today.At existing prices, as I said, roughly 25% of production or what is equivalent to the entire junior mining industry today would cease to exist by this time next year. So, to be clear, this would be an additional 25% reduction from the already reduced 2,200 ton number. This is potentially a very, very serious situation for the Western price manipulators because supply would continue to disappear at a rapid pace.You also have the World Gold Council weighing in with scrap production falling on their estimates. Scrap production has declined 25% alone in 2013. Well, that’s pretty interesting because none of our contacts in the scrap industry report that their numbers are down anywhere close to that. So the only way you can arrive at that conclusion, Eric, is, as so many insiders have been telling us, the scrap number is just a ‘plug’ for what the central banks do (in terms of supplying physical gold from Western vaults).You have to remember that if you look at the World Gold Council reports, there is no line item for gold which is sold into the system that was leased from central banks. Now this is amazing because we know this occurs. The central banks themselves have admitted it.The central banks control more gold than any other entity in the world, so how can the World Gold Council ignore such an important factor in the market? But they do. So central bank gold supply into the market is concealed through the scrap side of the business.Interestingly, Thomson Reuters confirms the World Gold Council’s scrap numbers. But Thomson Reuters will not share, and neither will the World Gold Council, their numbers with us. They won’t tell us where their sources are. They won’t document the numbers. They will just say, ‘take it or leave it.’ Well, I prefer to leave it. When someone says, ‘take it or leave it,’ and I’m paying for their service, I’ll leave it.I just don’t trust people that won’t come clean. We said, ‘Prove to us that you didn’t just make them up,’ and they refused to do it. So I am very suspicious of those (scrap) numbers. And I now side entirely with our sources, and we have more than one, who have said for some time now that ‘They just make this stuff up.’So this is how they attempt to camouflage what the central banks are doing in the physical gold market. Well, the Western central banks, as you and I have discussed in several interviews, are running out of gold. So, naturally the (scrap) number is going to drop markedly because the central banks are cutting back on their delivery of gold into the system because they are simply running out of gold.The Western central banks are running out of gold to deliver into the system, and the Eastern central banks and the emerging market central banks are net-buyers and they have no interest in selling. Take a look at India: India has a crisis going on. They bitch about having a current account deficit and their currency being attacked, but you don’t see the Indian Reserve Bank selling their gold, do you? The Reserve Bank of India only buys gold.The Indians could mount a very powerful defense of the rupee if they wanted to by simply selling central bank gold. But they refuse to do that. India is trying very hard to keep their citizens from buying gold, but all the central bank does is buy. They never sell.My advice to the KWN readers around the world is they should take their cue from what powerful entities like the Reserve Bank of India, which is one of the ultimate insiders in this game, are doing. Don’t pay attention to what they are saying. They are saying, and in particular to 1.1 billion Indians, to ‘Sell gold. And whatever you do, don’t buy gold.’ But meanwhile, all they do is buy gold and they don’t sell a single ounce. They won’t even do it to defend the currency. To me that’s a very powerful message about where they know the price of gold is headed.”

Monday, August 12, 2013

William Kaye Explains Gold Suppression & How it Works (And Ends)

Excerpts of the interview are below but I highly suggest listening to the entire interview yourself.

You can listen to the 24 minute interview here.

Kaye brings together all of the elements that I knew were there but just wasn't sure how they all fit together, from the Federal Reserve, JP Morgan, the Bank of International Settlements (BIS) and the GLD exchange traded fund and its true purpose (hint: its not for the benefits of retail investors). In this one interview Kaye, essentially explains everything I've written about for the last few years and provides everything you need to know about protecting your wealth (And maybe even making a lot of money) investing in gold.

And here is the original interview with KWN that prompted the follow up interview (Also an amazing interview).

Below is a partial transcript:

JP Morgan is Scrambling for Gold

Via Zerohedge:

The Color-Coded Comex Crunch: Behind The JPMorgan Golden "Musical Chairs" Scramble

Submitted by Tyler Durden on 08/12/2013 17:16 -0400

First, it was JPM asking HSBC for assistance and getting a handout of over 6k ounces of gold.

The next day, following a shut out by HSBC, JPM had no choice but to go to the second largest vault, that of Scotia Mocatta and get more than triple times that, or just over 20k ounces.

Today, the Comex gold crunch has gotten so confusing, nothing short of a color-coded schematic can do it justice.

Sunday, August 11, 2013

How Central Banks Manipulate Gold Markets

Watch from 2:25 to 11:20.

Though many people are aware that central banks intervene in currency markets, far less are aware that central banks consider gold as just another currency and regularly intervene to cap gold's price relative to a currency.

It should be obvious as to why. Since the end of Bretton Woods the USD, along with other major currencies, is not directly backed by gold. The "exchange rate" between gold and other currencies now floats rather than being fixed. If the US dollar or other currencies were declining in value relative to gold (i.e. the price of gold goes up in that currency) then people may choose to hold gold as a store of value rather than a paper currency. Fiat currency only has value if people believe it does.

Friday, August 9, 2013

The Bank Run on Gold Continues

JP Morgan especially seems to be scrambling:

Yesterday, it was HSBC. Today, the lucky respondent to JPM's polite gold 'procurement' request, is the second "fullest" New York commercial gold vault: Scotia Mocatta.

As ZH reported previously, following the announcement of an imminent withdrawal of 63.5k ounces of its gold (16% of the total), JPM's vault operations team promptly called around and to its disappointment was only able to procure a tiny 6.4k ounces: not nearly enough to preserve the impression that it is well-stocked. We then said, "None of which changes the fact that in a few days, the inventory in JPM's gold vault will drop to another record low of only 380K ounces and the JPM "rescue" pleas from HSBC and other Comex members will become ever louder and more desperate until one day they may just go straight to voicemail."

Today, as we predicted, the calls into HSBC indeed appear to have gone straight to voicemail (perhaps HSBC did not have any more unencumbered gold to share, perhaps it just didn't want to) which left JPM with just one option: go down the list.

Monday, August 5, 2013

Peter is Right

And this:

StreetTalkLive via Zerohedge

The media, the financial markets and investors have become fixated on the unemployment rate, as reported by the Bureau of Labor Statistics, particularly since it was directly linked by the Federal Reserve to its current bond buying program. With the latest gyrations in the markets over the last couple of months tied to "will the Fed taper or not" the focus on employment has become much more intense since the Fed has tied its bond buying to a 6.5% full employment target.

The problem for the Fed, the markets and the economy, is that the unemployment rate, in particular the U-3 report, has become completely irrelevant.In order for an economy to achieve a level of growth that becomes self-supporting, which means it doesn't require $85 billion a month in support to stay out of a recession, there are two primary requirements: 1) full-time employment growth that exceeds population growth, and; 2) a level of employment that absorbs the majority of currently available labor force. When these measures are met the available labor pool is reduced allowing for increases in wages and hours worked as competition for available jobs becomes increasingly more intense. In turn, increased employment leads to higher levels of consumption and stronger economic growth.

Currently, despite the Fed's ongoing monetary interventions, the economy continues to "struggle through" at an anemic pace due to the structural change that has taken place within the employment landscape. The issue for the Fed is the ongoing disconnect between the various employment reports and the real underlying issues with employment.

Tuesday, July 30, 2013

Maguire: Absolutely, there's a Run on the LBMA & Gold Banks

First, if you are not up to speed on the GoFo rates, or have no idea what they are, spend thirteen minutes listening to Alasdair Macleod explain the current extraordinary situation and what it means for gold.

Interview starts at 13:04

Now, armed with that knowledge, listen to Andrew Maguire, also on the Max Keiser Report starting at 13:12

Clearly the Western central banks are in trouble. This is extremely important because if you believe gold retains its intrinsic value irregardless of fiat money printing going on around the world and bankster manipulation of the price of gold then you must conclude gold is very much under priced in the paper markets. This is well and good, but if manipulation was able to continue on forever you could stack gold for years and never benefit from an honest repricing of your gold holdings.

The end of that manipulation seems to now be coming to an end.

Wednesday, July 24, 2013

Trust In the Gold System is Breaking Down

I believe we are now at a very important moment where the price of paper gold is beginning to disconnect from the physical price of gold. Premiums for gold delivery on the Shanghai exchange are now a constant and bullion banks and the COMEX are low on physical inventory for delivery. Although its unlikely the US Fed, BIS or IMF would let a gold exchange completely fail, its likely at some point there will be only cash settlement. Remember, its thought that there are 100 paper ounce representations of gold for every real physical ounce in existence. That means, as I mentioned previously, when the music stops, there will not be enough real gold to deliver. The music may not be abruptly stopping, but I can hear it fading away.

From KWN:

From KWN:

Kaye: “Part of the reason we’ve had this smash on gold is because it was very important to the central bankers and to the BIS that gold and silver not be seen as a viable alternative currency. The reality is that the physical above ground stock of gold only increases at roughly 1% to 2% each year,whereas the amount of digital money that is printed by the Federal Reserve of US dollars greatly exceeds that by a huge factor.

“Now the central bankers are devious but not stupid. They know that what I just said is true and they know that the market will catch on to that very quickly, so it’s very important for them to manage and suppress the price of gold, and that’s what they have done through the paper market.

Sunday, July 21, 2013

Where the Gold's Going

Santiago Capital, right here in San Francisco has two great presentations on the current gold markets

The first (10 minutes) reviews concepts familiar to my regular readers, while the second (6 minutes) expands on the first providing additional insight into where physical gold is going.

For newer readers these are a must watch.

Saturday, July 20, 2013

Friday, July 19, 2013

The Run on the Gold Banks Continues

JPM Eligible Gold Plummets By 66% In One Day To Just Over 1 Tonne, Total Gold At Fresh All Time Low

Submitted by Tyler Durden on 07/19/2013 16:31 -0400For over a month, JPMorgan managed to mysteriously avoid matching up the gold held in its (world's largest) vault with the Comex delivery notice update. However, as of today, that particular can will be kicked no more. Starting yesterday, JPM reported that just under 12,000 ounces of Eligible gold (the same Registered gold that two days earlier saw its warrants detached and convert to eligible) were withdrawn from its warehouse 100 feet below CMP 1. But it was today's move that was the kicker, as a whopping 90,311 ounces of eligible gold were withdrawn, accounting for a massive 66% of the firm's entire inventory of non-Registered gold, and leaving a token 46K ounces, or a little over 1 tonne in JPM's possession.

Wednesday, July 17, 2013

On Shanghai, Gold Bifurcation and How Long this Farce Can Continue

Jan Skoyles from The Real Asset Company talks about gold bifurcation, huge deliveries in Shanghai and just how long this Comex cognitive dissonance between paper and physical can continue. Hat top to tfmetals who brought this to my attention.

The conversation starts at twelve minutes into the video.

Tuesday, July 16, 2013

Rick Rule: On Gold, Hand Holding and Becoming Wealthy

Its been a tough two years for gold and silver investors. Even while the fundamentals for owning them have gotten even better ($85 billion per month of new money creation and annual US budget deficits of $1 Trillion.) the prices have been pummeled lower, almost certainly through intervention of central banks and/or their proxies. If you didn't buy prior to the start of this blog you have almost certainly sustained paper fiat currency losses. That can be frustrating for anyone. But the title of this blog relates to long term wealth preservation not short term trades. Sometimes wealth preservation means avoiding shorter term risks (an overvalued equity market) in favor of longer term investments that are more backed by fundamentals. That means giving up speculative gains for likely, longer term certainty and gains. Below, Rick Rule, who has been through more market cycles than I explains the wisdom he has acquired over the long term that made him a wealthy investor:

From KWN:

Rule: “You know, Eric, it’s funny because right now I am up in Vancouver, and looking at the despair in the professional investment community and juxtaposing that with the strange elation that I feel has caused me to feel very contemplative.One of the things that occurs to me is that this is my fourth major market cycle. The three previous down-cycles that I’ve been through previously were the cause of my personal wealth, and Eric Sprott’s personal wealth....

“It’s interesting that at age 60 I have a lot more patience than I did when I was age 30. And I think one of the things that’s happening right now is the fact that markets and conditions have caused me to be a 3-to-5-year thinker, and most of the people I compete with, who are 20 years younger than me, have a 2-to-3-week time frame.And the idea that somebody who has a 2-to-3-week times frame can compete with somebody who has a 3-to-5-year time frame is very problematic. What Eric and I are trying to do in very crass terms is go from being quite wealthy, to being ludicrously wealthy.But the reality is that we are competing with people who are trying to make payments on their 2nd house at Whistler. In other words we are competing with people who are trying to live rich as opposed to being rich, which constrains them to a very, very short time frame.Certainly I feel bad about having paid $3 for some stock that is selling at 60 cents, but it’s not the first time I’ve ever done that, and it’s certainly not the last time I am going to do that. But what I can tell you is that the money I’ve made in my life has come about through the aggressive deployment of capital at times like these.This is the case even though I may lose more capital in some of these, but also understanding the incredible increase in value that one gets by maintaining a 2-year, 3-year or a 5-year time frame in markets where your competition is so despairing that they are worried about how they are going to get through month-end.”Eric King: “Rick, is this one of the greatest opportunities you’ve ever seen in your entire career?”Rule: “I think so. This is my fourth major downturn, and in the first one I was really terrified because I hadn’t been through it before. But in the last three downturns I have known in every case that bear markets cause bull markets and that I was going to come out of it doing very well. I just didn’t know how well or how long it was going to take.I need to tell you that in each prior instance that I came out of it doing much better than I anticipated, and this time I believe that I am going to do incredibly well coming out of this market. Your readers need to remember that neither want nor hope are investment techniques, they are emotions. KWN readers need to think as opposed to wanting or hoping. And if they do that, and they lengthen their time frames, they will do much, much better with their portfolios as this market turns and heads to the upside.”Rule also added: “We need to remind ourselves, Eric, that the narrative with regards to precious metals has not changed between 2010 and today. The only thing that has changed is the price.

Sunday, July 14, 2013

In Case You Missed it: The Secret World of Gold

In light of recent events, this CBC documentary is more relevant than ever. Where is the gold?

My regular readers likely already know.

Friday, July 12, 2013

Paper Gold on the Comex Vs. Physical Gold in Shanghai

Since starting this blog gold bifurcation between physical and paper has gone from theoretical to reality. The only remain question going forward is by how much and how fast. As the post below from Real Asset Co shows, the mechanism is already there. There are to stark differences between two global gold markets: the COMEX in the US and the SGE in Shanghai.

Chinese gold demand, from both individuals and central banks, garnered increasing attention as the gold price rose consistently in the last twelve years. When the gold price declined, many in the West declared the end of gold, but China (along with many other Asian nations) defiantly continued to buy gold and increase their imports.

Questions over the legitimacy and transparency of COMEX and the London Gold markets are now becoming louder, especially as increasing numbers of institutions are keen to know what actually backs those contracts. ‘Paper gold’ is on everyone’s lips.

Thursday, July 11, 2013

Hey Merkel, Where's Germany's Gold?

William Kay says he knows:

Kaye: “Global hegemony (leadership or dominance) is changing in a way that most people don’t fully comprehend. This area of the world, the Asia-Pacific, China in particular, is positioning itself to be the leading global power as we look out over the next five to ten years.My sources tell me that contrary to the public numbers that are available, China has anywhere between 4,000 to possibly 8,000 tons of (physical) gold....

“They are not only the world’s largest producer of gold, but they are the largest importer of gold in the world.

Wednesday, July 10, 2013

$1.8 Trillion spending to create $320 Billion of GDP

In September of 2012 I wrote a post titled, Money Going Down a Black Hole in which I explained that Democrats, Republicans and the Federal Reserve were operation under the Keynesian notion that deficit spending was justified in a recession, depression or financial crisis to kick start the economy. The basic idea is that $1 of deficit spending would have a multiplier effect of greater than the $1 spent and result in higher economic activity.

The 2008 stimulus was based on this idea and projected a multiplier of 1.5, meanin for every $1 spent we would expect to see $1.5 worth of additional GDP. This didn't happen and John Cochrane put it closer to point five (.5). Biderman noted at the time that is was closer to point two (.2) which meant that it took a dollar of deficit spending to create 20 cents of new economic activity measured as GDP.

In the post above Biderman revisits this concept and notes its now barely .18. That's right, it now takes $1.8 Trillion to boost GDP by $320 Billion.

This is not only unsustainable, but points to diminishing marginal returns. The longer we continue creating and spending new money, the less effect it has on the economy. And of course, there is always the notion that we cannot print money forever.

Conclusion, this farce of a recovery will come to an end at some point. And when it does, we will be worse off, broke and our currency will be significantly devalued.

Tuesday, July 9, 2013

Ned Naylor-Lyland on the Run on Gold Banks

Scribd doc can be found here.

First a refresher: Backwardation refers to the market condition wherein the price of a forward or futures contract is trading below the expected spot price at contract maturity.With gold in backwardation one would expect institutions to buy gold today to deliver in the future at a higher price. Ned describes how backwardation of contracts should be a temporary phenomena that is arbitraged away. The fact that forward and futures contracts remains in backwardation implies a shortage of physical gold available to be delivered later. It also implies a premium for having physical gold now rather than the promise of gold in the future.

Ned Leyland from Cheviot Asset Management on the run on gold banks:

Gold Update

In light of the deep sell-off in the Gold price, I present 3 charts to clarify what has (and hasn’t) happened. Chart 1 is a chart of Spot Gold, the second an illustration of what makes up the daily ‘Gold’ market, the third shows the enormous flow of physical metal from West to East in the context of Global mine supply. There is an ongoing clash between the forces of paper supply and physical demand – paper supply has won the latest round, but its objective of satisfying and slaking demand for the real metal has failed entirely. The spot price graph is annotated with events that have happened since Q3 2012. All of these points (1-6) seem pertinent when evaluating the sell-off in paper Gold, but none more so than the entry of the Gold market into a state of permanent backwardation around a year ago (1). With vast above ground inventories (supposedly) available to borrow, the Gold and Silver markets should not offer a risk-free arbitrage for any amount of time. The fact that it has remained and widened over a year indicates that the physical market has tightened up substantially, a postulation that is corroborated by the growing premiums being paid in Shanghai and Delhi (in Delhi dealers are paying over a 25% premiumfor NNS 8g fine Gold vs 2% in Q4 2012) and the ongoing wholesale delays in the delivery of substantial bullion tonnage (2 tons or above).

Saturday, July 6, 2013

China Understands the Gold Game

Because I couldn't have written it better, below is cut and pasted from Zerohedge:

Sometimes, such as after pervasive liquidations in precious metals (or is that AAPL? Has it become clear yet that with widespread "quality" collateral shortages, gold and AAPL stock have become unexpected and almost interchangeable collateral replacements) it is easy to lose sight of the forest for the trees. A forest, in which the New York Fed is procuring (through the open market) the rehypothecated gold that the Bundesbank demanded for repatriation in January; in which JPMorgan's gold holdings have plunged by 75% since said stunning Bundesbank announcement and hit new record lows on a weekly basis paradoxically just as the price of spot gold keeps sliding ever lower; and in which China is importing unprecedented amounts of gold and adding more and more each month. So let's do a quick refresh on the forest, shall we.

Here is what we discovered in September 2011, as part of Bradley Manning's trove of declassified US cables. From Wikileaks:

And now for some empirical trees.3. CHINA'S GOLD RESERVES

"China increases its gold reserves in order to kill two birds with one stone"

"The China Radio International sponsored newspaper World News Journal (Shijie Xinwenbao)(04/28): "According to China's National Foreign Exchanges Administration China's gold reserves have recently increased. Currently, the majority of its gold reserves have been located in the U.S. and European countries. The U.S. and Europe have always suppressed the rising price of gold. They intend to weaken gold's function as an international reserve currency. They don't want to see other countries turning to gold reserves instead of the U.S. dollar or Euro. Therefore, suppressing the price of gold is very beneficial for the U.S. in maintaining the U.S. dollar's role as the international reserve currency. China's increased gold reserves will thus act as a model and lead other countries towards reserving more gold. Large gold reserves are also beneficial in promoting the internationalization of the RMB."

While we don't know how much of the several hundred tons that Jens Weidmann has demanded for delivery from Liberty 33 has already been purchased and/or delivered, we know one thing: since publishing the Wikileaks disclosure China has imported nearly 2,000 tons, and just under 1,500 tons since January 2012...

... and that Chinese gold imports in 2013 continue to surpass those from 2012 "despite" the violent slide in the gold price - almost as if unlike E*trade momentum chasing babies, China buys more the lower the price drops.

In other words, China - pragmatic as always - decided to call the "rising gold price suppression" bluff of the US and Europe and do the only logical thing that takes advantage of an artificially suppressed gold price: buy hand over fist.

As for everyone else selling their (mostly paper) gold over fears that this time, unlike the previous two, Bernanke will actually stop monetizing debt and in the process eliminate all concerns of monetary collapse, China is happy to wave it in (and why not: it is only a matter of time before the taper makes way for the untaper).

Finally, we concluded our previous post looking at recent gold technicals with the following rhetorical question:

Rhetorical, because we have a very good idea where this gold is going.Someone more inquisitive than us may wonder: just where is all this gold being "withdrawn" to...

And don't miss this:

JP Morgan Vault Gold Drops To New Record Low; Brinks Gold Plunges By 24% In One Day

Last week we defined the golden sentiment rule as "anything that isn't off the chart soon will be." This will happen in a "perfectly sustainable" fashion, where increasingly more paper gold is shorted to record levels even as actual physical holdings held by official Comex vaults continues to drop. For one particular reason why the price of paper gold may be at 3 year lows, we will provide some formerly classified perspective shortly in a post. But in the meantime, and while we await the weekly CFTC commitment of traders report (delayed until Monday due to the July 4 holiday), we are happy to report that the JPM disconnect between the epic delivery requests and its reported gold holdings (for which the "Commodity Exchange, Inc. disclaims all liability whatsoever with regard to its accuracy or completeness") reconnected modestly, and as per the latest Comex update, another 6.8k ounces of gold was pulled from JPM's 1 CMP world's biggest gold vault, dropping its total gold inventory to a fresh record low.

Perhaps even more notable is that on Friday, that "other" depository, Brink's, saw 24% of its entire registered gold holdings, or 133k ounces, quietly get withdrawn. This, together with the moves in JPM and HSBC inventory, meant that total Comex gold holdings dropped by 116K ounces to a new low not seen for the first time since 2006.

Finally, for that all important marginal source of paper gold supply or demand, ETFs,the two largest ones (GLD and IAU) have now retraced 50% of their "holdings" gain since the fall of Lehman.

Someone more inquisitive than us may wonder: just where is all this gold being "withdrawn" to...

Friday, July 5, 2013

Maguire on Last Week's Gold Action

Below is the text from a KWN interview with Andrew Maguire on last week's gold action. As you read, notice the amount of gold redemptions from ETF's compared to the amount of gold purchased by Eastern central banks in a similar period. And recall my thesis that paper gold price is being attacked to make more physical gold available from these ETF's when traders & investors sell the funds. Remember, with a open end ETF, the custodian must buy or sell the underlying metal to create or destroy shares so that the gold ETF's match the gold price.

Also notice how he mentions that from the perspective of the central banks (and also the Bank of International Settlements) the cross between the dollar and gold is just another currency cross. That is, just as central banks regularly and openly intervene in currency markets between, say, Japanese Yen and US Dollars, they also intervene in crosses between currencies and gold. Though Bernanke may not admit that gold is money, their policies and interventions in the gold market indicate otherwise.

Also, you may remember in my post about the BIS rejecting gold as Tier 1 capital. Had they allowed gold as Tier 1 capital it would in essence have admitted gold IS money and increased its desirability. Certainly that would not have been in the interests of Western and Japanese central banks.

Monday, July 1, 2013

"Buy Now While Supplies Last"

First let me apologize. In my last post I did not differentiate between the significance of both last Thursday and Friday. Explaining will make sense of the price action. Options and Futures on gold expired last Thursday which is why we saw the paper gold price being "attacked". Bullion banks desperately wanted to push down the price to 1) discourage physical delivery of the contracts and 2) push more people out of the GLD exchange traded fund which results in the fund having "excess physical" gold thy can make available to metals exchanges or bullion banks. Friday was the last day of trading for the second quarter marking the price that all anti gold news would use to mark the down quarter for gold as I predicted. But by Thursday the damage was done and the "paper gold attack" was over and gold price rose. As a result we predictably got this headline from CNBC:

Luster Gone: Gold Posts Worst Quarter on Record

Were you scared out of your gold? They certainly hope so, because the music seems to be stopping as I posted June 11th.

Subscribe to:

Posts (Atom)