It was six months ago that I wrote about Iceland succeeding where Greece had failed. In that post I pointed out that Iceland allowed its banks to fail, protected its citizens and prosecuted bankers that had committed crime. The result was sharp contraction in GDP in 2009 followed by a normal recovery and return to about 3% growth. When I wrote that last post in February Iceland's credit rating had already recovered to BBB- by Fitch, a lower, but still investment grade rating. Today, Nobel Prize economists and even the IMF (who's prescription for ailing countries is usually more similar to the path of Greece) has recognized that Iceland is a success and has clearly done the right thing.

Via Zerohedge:

Nobel prize winning economist Joe Stiglitz notes:

What Iceland did was right. It would have been wrong to burden future generations with the mistakes of the financial system.Nobel prize winning economist Paul Krugman writes:

What [Iceland's recovery] demonstrated was the … case for letting creditors of private banks gone wild eat the losses.

Icenews points out:

Experts continue to praise Iceland’s recovery success after the country’s bank bailouts of 2008.Barry Ritholtz noted last year:

Unlike the US and several countries in the eurozone, Iceland allowed its banking system to fail in the global economic downturn and put the burden on the industry’s creditors rather than taxpayers.

***

The rebound continues to wow officials, including International Monetary Fund chief Christine Lagarde, who recently referred to the Icelandic recovery as “impressive”. And experts continue to reiterate that European officials should look to Iceland for lessons regarding austerity measures and similar issues.

Rather than bailout the banks — Iceland could not have done so even if they wanted to — they guaranteed deposits (the way our FDIC does), and let the normal capitalistic process of failure run its course.

They are now much much better for it than the countries like the US and Ireland who did not.

Krugman also says:

A funny thing happened on the way to economic Armageddon: Iceland’s very desperation made conventional behavior impossible, freeing the nation to break the rules. Where everyone else bailed out the bankers and made the public pay the price, Iceland let the banks go bust and actually expanded its social safety net. Where everyone else was fixated on trying to placate international investors, Iceland imposed temporary controls on the movement of capital to give itself room to maneuver.

Even "more monetary stimulus Krugman" now sees that letting banks fail leads to a quicker recovery. We can see what the alternative brings by looking at Japan where "zombie banks" were preserved at the expense of economic growth resulting in two decades of economic depression.

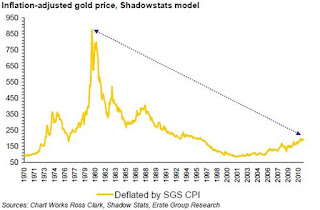

As you can see from the chart above their growth rate has averaged between zero and one % of GDP. This in spite of the same ZIRP policies that we are now trying here in the US.

I would argue that zero percent interest rates has not been a stimulus but rather have been an impediment to the efficient allocation of capital. Clearly ZIRP has not gotten Japan out of their economic slump.

But Iceland did more than just allow their banks to fail, and this, I believe, is an important lesson for use here in the US:

Barry Ritholtz noted last year:

Rather than bailout the banks — Iceland could not have done so even if they wanted to — they guaranteed deposits (the way our FDIC does), and let the normal capitalistic process of failure run its course.Bloomberg pointed out February 2011:

They are now much much better for it than the countries like the US and Ireland who did not.

Unlike other nations, including the U.S. and Ireland, which injected billions of dollars of capital into their financial institutions to keep them afloat, Iceland placed its biggest lenders in receivership. It chose not to protect creditors of the country’s banks, whose assets had ballooned to $209 billion, 11 times gross domestic product.And Iceland’s prosecution of white collar fraud played a big part in its recovery:

***

“Iceland did the right thing … creditors, not the taxpayers, shouldered the losses of banks,” says Nobel laureate Joseph Stiglitz, an economics professor at Columbia University in New York. “Ireland’s done all the wrong things, on the other hand. That’s probably the worst model.”

Ireland guaranteed all the liabilities of its banks when they ran into trouble and has been injecting capital — 46 billion euros ($64 billion) so far — to prop them up. That brought the country to the brink of ruin, forcing it to accept a rescue package from the European Union in December.

***

Countries with larger banking systems can follow Iceland’s example, says Adriaan van der Knaap, a managing director at UBS AG.

“It wouldn’t upset the financial system,” says Van der Knaap, who has advised Iceland’s bank resolution committees.

***

Arni Pall Arnason, 44, Iceland’s minister of economic affairs, says the decision to make debt holders share the pain saved the country’s future.

“If we’d guaranteed all the banks’ liabilities, we’d be in the same situation as Ireland,” says Arnason, whose Social Democratic Alliance was a junior coalition partner in the Haarde government.

***

“In the beginning, banks and other financial institutions in Europe were telling us, ‘Never again will we lend to you,’” Einarsdottir says. “Then it was 10 years, then 5. Now they say they might soon be ready to lend again.”

[The U.S. and Europe have thwarted white collar fraud investigations ... let alone prosecutions.] On the other hand, Iceland has prosecuted the fraudster bank heads (and here and here) and their former prime minister, and their economy is recovering nicely … because trust is being restored in the financial system.

In my previous post I wrote my conclusion which is just as accurate as ever:

Lesson for us in the USWhile Iceland sent its banksters to jail, not a single one here in the US has gone to jail for the massive fraud perpetuated on the American people and the international investors who bought the mortgage derivatives thrown together with loans signed by “Linda Green”. Even now, not a single arrest has been made resulting from the theft of over a $1 Billion after MF Global stole client money from segregated accounts. In addition, rather than bailing out their banks as the US did, they partially nationalized them. The advantage of this is that there is now an expectation that the government won’t bail them out while in the US the big banks know Bernanke and Congress will always bail them out no matter how bad their behavior. They can keep the profits in the good times and be bailed out by struggling Americans in the bad times.

Worse, rather than the banks being nationalized, they were allowed to sell their losing mortgage derivative to the US Fed, backstopped by the US taxpayer. Then they were on the one hand allowed to switch from “mark to market” to “mark to myth”. That is, just valuating their failed loans at whatever price they deemed correct. Finally, on the other hand as the Fed embarked on its ZIRP (Zero Interest Rate Policy) policy banks were able to use an accounting trick to revalue their own debt to show phantom income as if they had refinanced their own outstanding debt at the lower rate.

While Iceland’s banks were allowed to fail, Greece is trying to extend and pretend as they always have, following the US’ example. Iceland has endured difficulty but has recovered and is now growing again. The US and Greece however are following the Japanese who have been mired in an economic depression for two decades. We should not expect to have different results.